THE FEDERAL 25C TAX CREDIT ON WOOD AND PELLET STOVES CAN SAVE YOU UP TO $2000!

How so?

With the August 16, 2022, signing of the Inflation Reduction Act (IRA), a new legislation was signed to create an Investment Tax Credit (ITC) for home heating equipment. This 30% Tax Credit is under section 25(C) of the US Internal Revenue Code (IRC or Tax Code). It came into effect on January 1st, 2023 and will last until December 31st, 2032. So we are good to use it in 2025. There has been no change under the new Trump Administration.

What is the Wood and Pellet Heater 25(C) Tax Credit?

Since January 2023, the stove tax credit has been set to 30% with a $2000 cap, annually, with no lifetime limit.

This Wood and Pellet Stove Tax Credit is the most there has ever been in our recent history. The 30% tax credit is calculated from the total cost of the appliance and its installation cost, including the chimney, the floor protection and labor. Further down in this article, we will present you with a few scenarios on how generous this program is.

Do all pellet and wood fireplaces qualify for the federal tax credit?

The answer is no. In fact, most wood stoves, inserts and fireplaces on the Market do not qualify. Why? The legislation aimed at helping consumers get more efficient heaters. So, the ITC is requiring the biomass-fueled stoves (wood or pellet heaters) to boast an HHV* of 75% efficiency or higher. (HHV stands for Higher Heating Value) At the time we are writing this article, there were 148 listings of wood heaters approved by EPA. Only 52 of them qualify for the Tax Credit. 51 Pellet Stoves qualify out of 101.

How do I know if the stove I am buying qualifies for the federal tax credit?

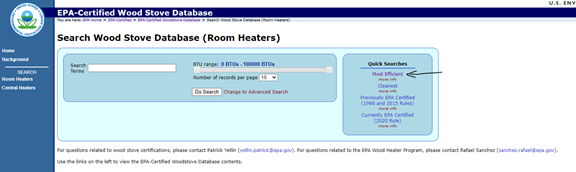

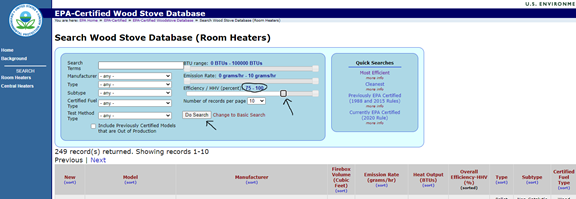

The EPA has created and is maintaining the official Wood Stove Database. As you get on the database, click on ‘Most Efficient’ to start your search. Move the Efficiency Indicator to bring it to 75% efficiency and click on ‘Do Search’. This will generate the list of all pellet and wood heaters that are 75 percent efficient and more. If the heater you are shopping for is not on that list, it simply does not qualify for the Federal Tax Credit. It is important that you refer to this list, as this is where the IRS is looking into when auditing.

Is the 30% tax credit really worth it?

Most of the heaters that qualify are more expensive than those that do not. The question is relevant. Heaters found in Mass Merchants are so much cheaper, is it really worth the trouble? Well, how about we do the Math together?

Example 1 –

Medium Size Wood Stove sold at a Mass Merchant: $1000 to $1200; Chimney System: $1800; Hearth Pad: $400; Installation: $1000= Total: $4200-$4400

Medium Size Wood Stove Qualifying for Tax Credit, sold at a We Love Fire Partner Store: $2999, Chimney System: $1800; Hearth Pad: $400; Installation: $1000 = Total: $6199 less 30% ($1859.70) = $4339.30

For about the same amount, you are getting a cast-iron stove made in the USA, with high-quality soapstone inside and a very strong warranty. Plus, our partner stores will take very good care of you.

Example 2:

Medium Size Pellet Stove sold at Mass Merchant: $1899. Chimney System $600; Hearth Pad: $400; Installation: $600; Total: $3499

Medium Size Pellet Stove Qualifying for Tax Credit, sold at a We Love Fire Partner Store: $3999, Chimney System: $600; Hearth Pad: $400; Installation: $800 = Total: $5799 less 30% ($1739.70) = $4059.30

For less than $600 more, you get a much nicer stove, made in the USA or Europe, quieter, more reliable, etc.

Not only the gain in energy efficiency will make you save on fuel over the next two decades, but you get a very good upgrade for a little more money. If you were offered to buy a Cadillac for $500 more than a Kia, would you not do it?

If the IRS is offering you money to enhance your home, why not do it?

Another benefit is in the spirit of it. For some of us, we like to support local family businesses. Buying local feeds our local economy. Our network at We Love Fire is solely based on family businesses across the country. We pride ourselves on offering high-quality products and services. This is why we will be ones to feature heaters that qualify for higher energy efficiency standards.

Hearthstone Bari Plus 8172 Wood Stove

What do you have to keep on record to claim the Tax Credit?

You should keep the sales receipt and any installation paperwork and the heater certificate from the manufacturer.

The We Love Fire Partner Store from whom you purchased the qualifying heater will provide you with a manufacturer’s certification statement indicating that the product qualifies for the tax credit. You aren’t required to have a manufacturer’s certification statement in order to claim the tax credit. A screenshot or printout of the product manual page listing the energy efficiency as at least 75 percent efficient per the HHV is sufficient. Here’s an example of a Certificate.

How Do You Claim Your Federal Tax Credit?

You claim the 30% tax credit on your federal income tax return form. The credit is a reduction of the total income tax owed. This is a non-refundable tax credit available for individuals who pay federal taxes.

If your tax owed is reduced to zero by this credit, but you still have money left to claim, it can be carried over to the next tax year to further reduce your tax burden in the future.

You should always consult a tax professional as individual situations may vary.

Paper Filing: The credit can be claimed on IRS Form 5695 under Residential Energy Efficient Property Credit. If you are eligible to claim the tax credit, the amount has to be entered on line 5 of tax form 5695. Biomass is specifically mentioned on the form and on its own line. The credit may be claimed in the year in which a qualifying product is installed. So, if your stove or fireplace is purchased in 2024 but not installed until 2025, you will then claim the credit on your 2025 tax return.

Electronic Filing: If you are using tax filing software, the credit generally will be found under the “Credits” section of the Federal portion (Home Ownership – Residential Energy Credit).

If you made a qualifying purchase and installation in a previous tax year and want to claim the credit this year, you need to file an amended return using IRS Form 1040-X.

Hearthstone Manchester Wood Stove

Where can the qualified heater be installed?

It may be installed in your primary home, secondary home, vacation home, a new or existing home. The only restriction is that the property where it is installed cannot be an investment property such as a rental home.

There is no stated limit from the IRS as to how many qualified heaters you may buy and claim the stove Tax Return for.

It is always best advised to talk to your Tax Advisor.

What are the We Love Fire favorites on the Tax Credit Qualified Heaters?

We have 2 brands that we love who qualify. Hearthstone & Ambiance. To see the models that qualify, use the table below.

| BRAND | MODEL | EFFICIENCY |

|---|---|---|

| Ambiance | Hipster 14 | 79% |

| Ambiance | Hipster 20 | 79% |

| Hearthstone | Green Mountain 40 | 79% |

| Hearthstone | Green Mountain 60 | 79% |

| Hearthstone | Green Mountain 80 | 81% |

| Hearthstone | Castleton | 77% |

| Hearthstone | Manchester | 78% |

| Hearthstone | Craftsbury | 79% |

| Hearthstone | Shelburne | 79% |

| Hearthstone | Heritage | 77% |

| Hearthstone | Bari | 76% |

| Hearthstone | Bari Plus | 76% |

Do you have any question on the Federal Tax Credit?

We are here to help! Send us a message or reach out to your local We Love Fire store. The IRS produced a Frequently Asked Questions document that you may find helpful. Click here to view the pdf copy.

*What is the HHV Efficiency? The Higher Heating Value refers to the ‘value’ of heat available from the fuel. In the case of wood, one pound of wood as found in firewood will generate about 8500 BTU on average.

The opposite of HHV is LHV, or Lower Heating Value. If we were able to remove all moisture content from the wood, one pound of it would be a larger piece, thus generating more BTU. The LHV efficiency calculation removes the ‘water’ or moisture from the wood to find the net (or lower) value of heat from the wood itself.

The HHV efficiency takes the piece of wood including its ‘water’ or moisture, as found in real life to calculate its ‘real’ or higher heating value. The HHV calculation is more representative of the firewood used by homeowners when heating with wood. That is why the EPA and IRS are both using this method as the official way to measure efficiency on wood and pellet stoves.

61 Responses